In August 2023, the European Commission adopted the reporting rules of the Carbon Border Adjustment Mechanism (CBAM) during its transitional phase, which starts on 1 October 2023. The new CBAM will have direct and indirect impact on EU companies that import the CBAM-covered goods and their suppliers. This article serves as a guide to understanding the essence of CBAM and offers strategic recommendations for seamless adaptation.

OVERVIEW

- What is Carbon Border adjustment mechanism?

- What products and emissions are in the scope of the CBAM?

- How does CBAM work?

- What to do next and how can we help?

1. WHAT IS CARBON BORDER ADJUSTMENT MECHANISM?

CBAM stands as a pivotal instrument within the European Green Deal (the EU’s comprehensive policy framework aiming to reach net zero emissions by 2050). It will enter into its transitional phase on 1 October 2023.

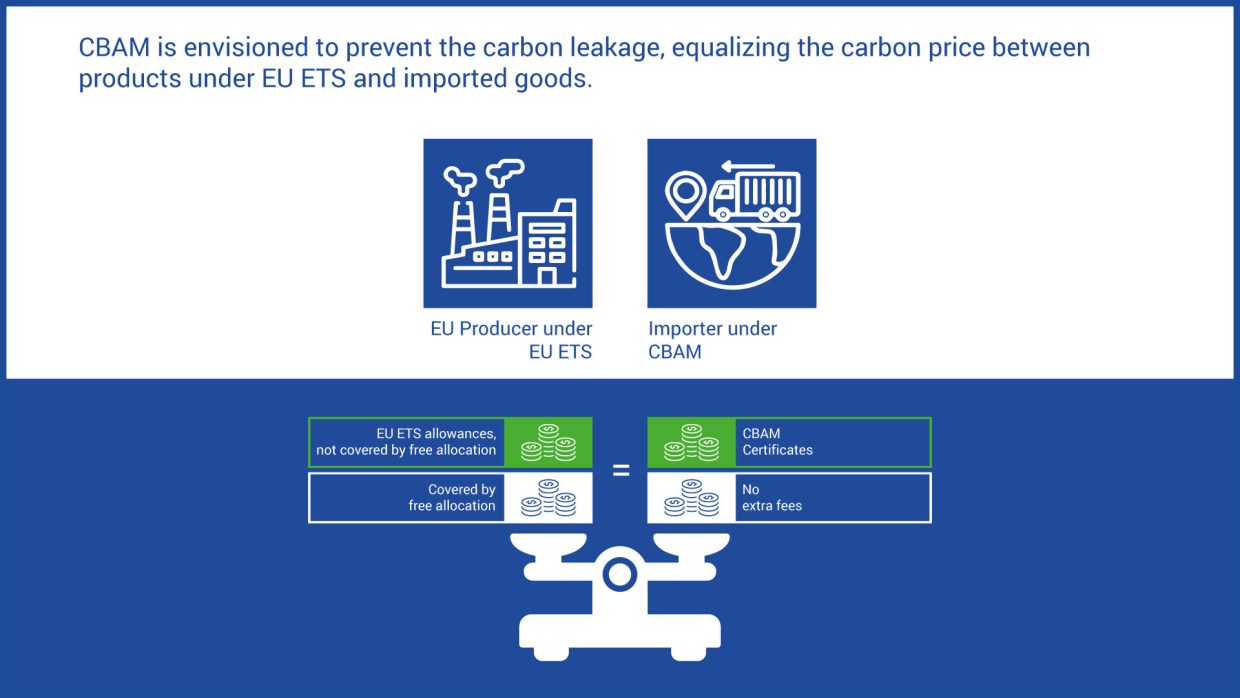

The CBAM is envisioned to prevent the risk of carbon leakage, which occurs when stringent emissions regulations drive companies to relocate their production to regions with less strict environmental standards, resulting in increased global emissions.

As a supplementary facet of the EU Emission Trading System (ETS), CBAM operates with the ambition of equalizing carbon price between products governed ETS and imported goods across borders. CBAM and ETS can work together to align trade and climate objectives, affording a coherent carbon pricing framework applicable to both EU and imported goods.

2. WHAT PRODUCTS AND EMISSIONS ARE IN THE SCOPE OF THE CBAM?

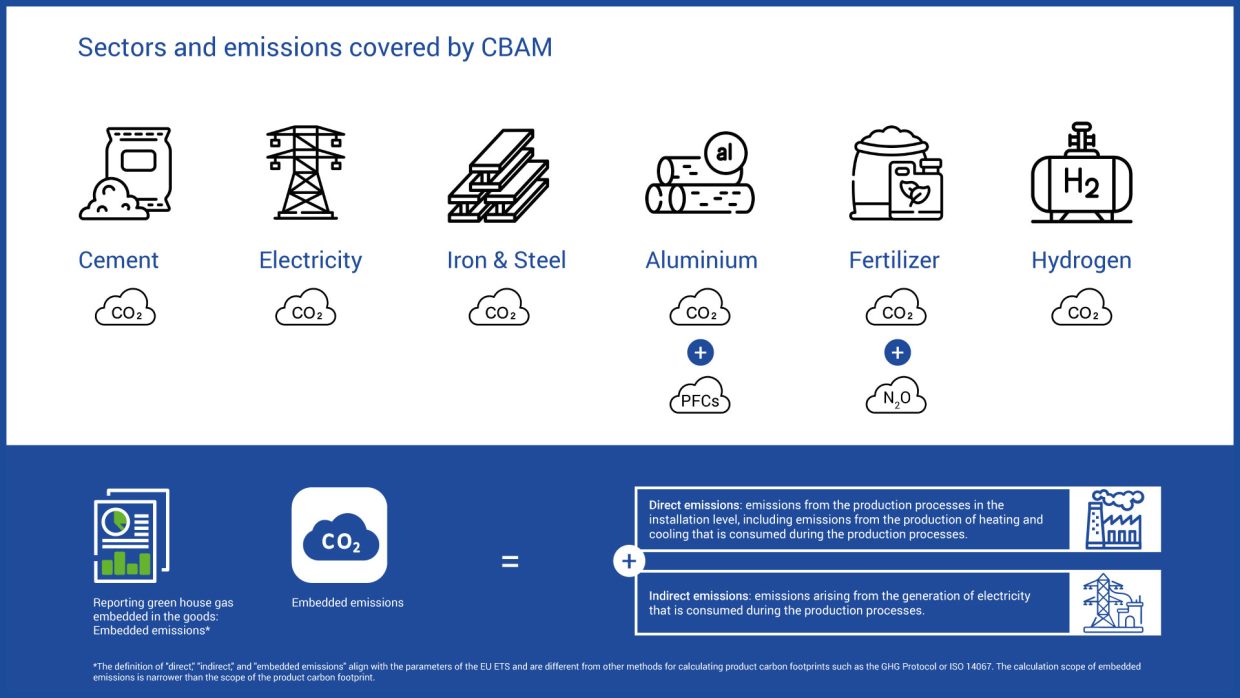

CBAM’s initial scope covers imported goods and designated precursor goods originating from non-EU countries (exceptions: Iceland, Liechtenstein, Norway and Switzerland). Presently, the CBAM targets six major categories: cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen.

These sectors have been selected due to their high risk of carbon leakage and their substantial carbon emissions. As stated officially, upon achieving complete integration, the CBAM’s current scope will encapsulate over 50% of the emissions stemming from sectors already encompassed by the ETS.

3. HOW DOES CBAM WORK?

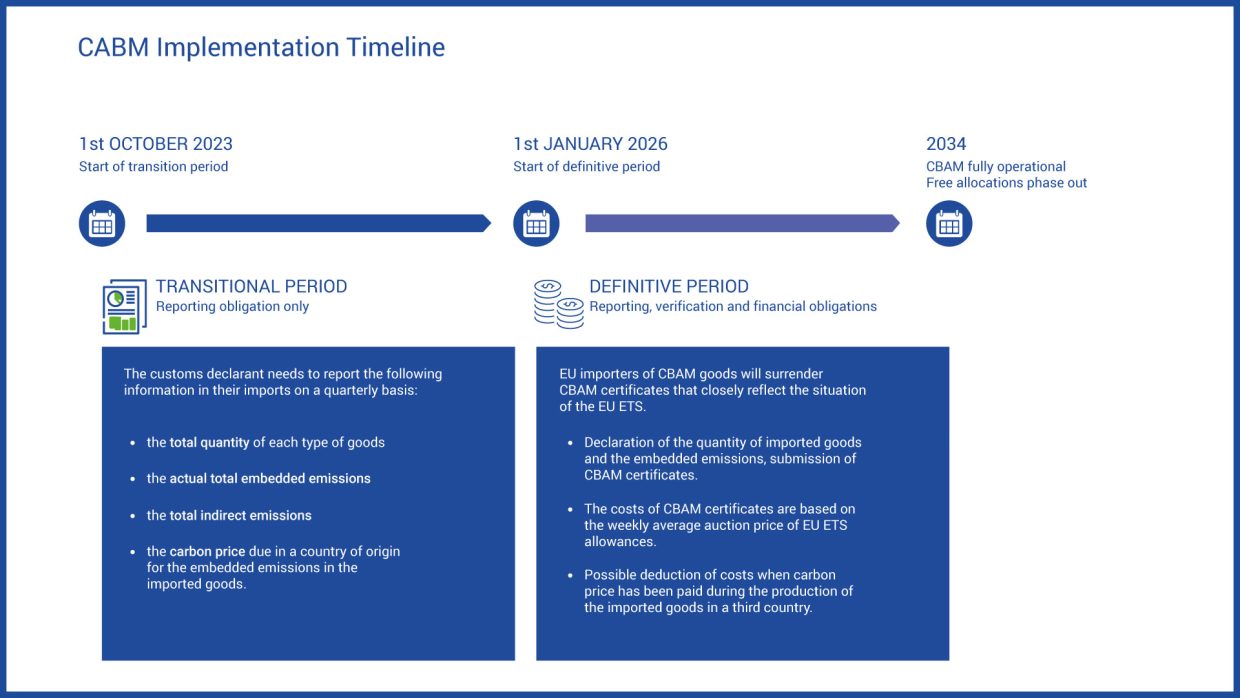

CBAM will be implemented in two phases:

1. Transitional phase 1 Oct.2023 – 31 Dec. 2025:

The customs declarants (the importer or the indirect customs representative) are responsible to submit a CBAM report on a quarterly basis. A CBAM report includes the following information:

- the total quantity of each type of goods;

- the actual total embedded emissions;

- the total indirect emissions;

- the carbon price due in a country of origin for the embedded emissions in the imported goods.

There is no verification obligation during the transitional phase.

2.Enter into force (definitive period) from 1 Jan. 2026:

EU importers of CBAM goods will need to surrender CBAM certificates that closely reflect the situation of the EU ETS. It means that the CBAM certificates mirror the ETS price.

In the definitive period, the CBAM-covered goods will entail the reporting, verification and financial obligations. Declared embedded emissions must be validated.

From 2026 to 2033, CBAM will progressively cover embedded emissions for goods, as at the same time free allocation under the EU ETS is gradually phased out. This approach ensures equitable treatment between importers and EU producers, thus CBAM will only apply to the proportion of emissions that does not benefit from free allowances under the EU ETS. Composite end products involving the six listed categories of raw materials (e.g., batteries, automotive, machinery parts, etc.) will not be included in CBAM in the near future.

4. WHAT TO DO NEXT AND HOW CAN WE HELP?

In the short term, the introduction of the CBAM directly affects both EU companies that import CBAM-covered goods and their respective suppliers outside the EU. Immediate action is necessary to meet the CBAM reporting requirements.

Looking ahead, the CBAM’s influence will extend to all sectors encompassed by the EU ETS, including even downstream industries. Currently (August 2023) the price of carbon emission is around 90 €/tonne. Projecting to 2026, when the financial obligations come into play, a raised price of CBAM-covered goods from non-EU countries is predictable. For EU importers, a comprehensive recalibration of the overall cost structure and an assessment of potential suppliers become imperative. Conversely, for non-EU suppliers, the key to enhancing competitiveness lies in bolstering sustainability management and investing in low carbon technologies. By embracing these strategies, non-EU suppliers can position themselves advantageously in a fast-changing global trade landscape.

For the upcoming phases, there are some recommendations to pave the way forward.

For EU Importers of CBAM-covered goods:

- Evaluate the origins and procurement process of CBAM-covered imports.

- Analyze the complete product portfolio impacted by CBAM, considering potential economic ramifications beyond 2026.

- Implement a carbon accounting process to systematically track embedded emissions in relevant products.

- Prepare necessary information and seamlessly integrate new requirements into procurement and relevant workflows.

- Foster collaboration and communication with affected suppliers to address key concerns.

For Non-EU suppliers/installation operators for CBAM-covered goods:

- Assess CBAM-covered goods and anticipate potential future economic implications.

- Establish a comprehensive carbon accounting process to systematically monitor emissions of products, including the identification of installation boundaries and production routes.

- Innovate clean technologies to mitigate greenhouse gas emissions during production processes.

- Acquaint yourself with local regulations concerning emissions trading systems and participate accordingly.

- Influence your country’s emissions legislation, for example, through associations. The introduction of a local emission price means that the expenditure remines in the origin country and can be used there for the emission reduction. The amount paid will be fully credited to the EU import.

P3 can support you for implementing CBAM requirements from an operational as well as a strategic perspective:

- Assess the CBAM-impacted product portfolio and gauge its effects.

- Devise a roadmap and holistic strategy for both the transition period and the definitive period beyond 2026, grounded in CBAM compliance.

- Employ tool-assisted calculations for embedded emissions in CBAM-covered goods.

- Introduction of emission reduction measures and implementation of a detailed target achievement process.

- Establish requisite monitoring and reporting mechanisms.

- Step-by-step guidance of customs reporting process for target goods.

If you have further inquiries about CBAM or seek information on our services, please don’t hesitate to contact us.